What Is the Program?

Value Acceptance + Property Data comprises an important new addition to Fannie Mae’s Valuation Modernization Program. Per Fannie, this initiative is “Empowering lenders to better serve their customers through a spectrum of options that foster a more efficient, understandable, and impartial valuation system, saving time and money in the origination process.”

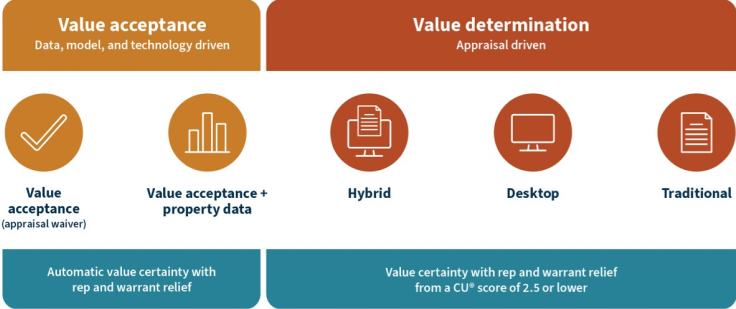

The graphic below illustrates the valuation spectrum and highlights where Valuation Acceptance + Property Data fits into the overall scheme. Fannie states, “We’re transitioning to a spectrum of options to establish a property’s market value, with the option matching the risk of the collateral and the loan transaction. The spectrum balances traditional appraisals with appraisal alternatives.”